Tax classes

Tax classes allow you to configure taxes the customers pay when purchasing in your on-line store. You can specify different tax classes with different rates for each country or state and then apply the taxes to particular products and shipping options.

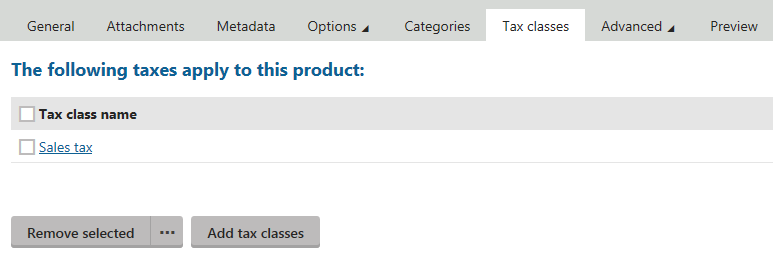

When editing a product (on the Tax classes tab), you can specify which tax classes will apply to this product when purchased in your on-line store. You can do this by clicking Add tax classes and selecting appropriate tax classes in the displayed selection dialog.

In the same way, you can assign tax classes also to shipping options (in Store configuration -> Shipping options -> Tax classes).

Managing tax classes

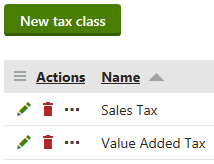

You can manage tax classes in the Store configuration application on the Tax classes tab (or in Multistore configuration -> Tax classes; global tax classes only). Here, the system displays a list of all defined tax classes. You can add new tax classes by clicking New tax class, and you can modify properties of existing tax classes after clicking Edit () in the Actions column. You can also remove tax classes from your on-line store by clicking Delete () next to respective tax class items.

When editing a tax class, the system offers the following tabs to specify its properties:

General

Here you can edit general properties of the current tax class.

- Display name - specifies the name of the tax class displayed to users on the live site and in the administration interface.

- Code name - specifies the name of the tax class used by developers in the code.

- Zero tax if Tax ID is supplied - indicates whether the system calculates the tax as zero (0) if the customer enters a Tax ID.

Countries

Here you can specify values of the currently edited tax for selected countries. Recognition of the country is based on the respective order’s billing address or shipping address, as specified in the Apply taxes based on setting (available in Settings -> E-commerce). The value can be either a percentage of the product price (by default) or a flat amount. If the tax is specified for both a country and state, the system applies only tax specified for the state.

States

Here you can specify values of the currently edited tax for selected states. Recognition of the country and state is based on the respective order’s billing address or shipping address, as specified in the Apply taxes based on setting (available in Settings -> E-commerce). The value can be either a percentage of the product price (by default) or a flat amount. If the tax is specified for both a country and state, the system applies only tax specified for the state.

Products

The Products tab is hidden while editing global tax classes in Multistore configuration -> Tax classes.

The Products tab allows you to specify to which products the currently edited tax class applies. To add products, click Add products and select appropriate products in the displayed selection dialog. You can remove selected products from the list at any time using the Remove selected action. You can also remove all listed items at once by clicking … and performing the Remove all action.

You can specify default tax classes also on the department level (in Store configuration -> Departments while editing a selected department on the Default tax classes tab). This means that the system automatically applies the selected tax classes to all new products from the given department.

Moreover, you can specify a default department for each new product on the page type level (in Page types while editing a selected page type on the E-commerce tab).